1. What is Income Certificate?

Income certificate is an official statement provided to the citizen by the government confirming his annual income from all sources. It is issued by the Tahasildar as per Odisha Miscellaneous Certificates Rules,2019. As per the said Rules, "income" means income from all sources,i.e.salary, agriculture, business, profession etc. While granting income certificate,income of all members of the family living in a common mess from all sources i.e. income from salary,wage, remuneration in whatever form received from Government service/P.S.U. or private, income from the movable properties, income from trade or business or professions; income from agriculture etc. during the financial year prior to the year of application shall be taken into account. The income certificate is applied in Form No.3 and issued in Form No.III. It is an essential document for the admission of students and different Government schemes.

2. Who is eligible for income certificate in Odisha ?

A person desirous of obtaining income certificate can file the application. In case of a minor or person incapable of managing his/her own affairs,the family members/guardian can file application before the Revenue Officer for issue of income certificate. In most cases, the parents apply for the income certificates.

3. What is the validity period of income certificate in Odisha ?

The Revenue and Disaster Management Department, Odisha had amended the Odisha Miscellaneous Certificates, Rules,2017 in the year 2018 mentioning therein that income certificate is valid for 3 years from the date of issue. However, with the coming into force of the Odisha Miscellaneous Certificates Rules,2019, the said amendment has become inoperative. Now Income certificate is valid for the financial year during which it is issued.

4.What are the documents required for income certificate ?

The following documents are required for income certificate.

- Copy of RoR

- Salary Certificate,if any

- IT Returns,if any

- Documents in support of other incomes(it should be specified)

5. How to apply income certificate online?

You can apply income certificate online as follows:

- Visit the eDistrict Odisha portal. Login to the portal using your Login ID and password. If you don't have the login credentials, then get yourself registered in the portal. You can check here how to register in the portal.After successful login,the main page of the portal will appear.

- Click on the Tab Apply for services. Then click on View all available Services. The list of all available services will open. Select Issuance of Income Certificate and click on the same.

- Form No.3 will appear.It has ten(10) parts. Let us know how to fill up the same.

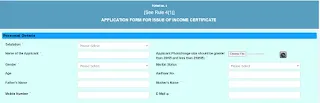

- The First Part is all about your personal details. Select your salutation (Shri, Smt, Miss) from the dropdown. Fill up your name and select your gender from the dropdown box. Then mention your age, father's name, Mother's name, marital status, AADHAR number, mobile number, and Email. All these fields except the Email are mandatory. Keep in mind that if you provide your email, then the certificate will be sent to your mail by the system. So always try to provide your correct Email. Upload your photograph(Size between 20KB to 250KB).

- In the Second Part, you have to provide your Present Address. Select the District, Tahasil, Village, and RI from the Dropdown. If your village is not in the list, then click on the box provided for this. On clicking the box, you can manually fill up the name of the village, Police Station, Post Office, and Pin Code in the relevant fields.

- The Third Part is about Permanent Address. First, select the state. If your present and permanent address is the same, then select Yes against the field in the second tab. If you belong to Odisha and your present address is different from the permanent one, then select No in the Dropdown in the second tab and fill up all relevant details. If you belong to any other State and have been staying in Odisha, then select your State from the dropdown and fill up the necessary details manually.

- In the Fourth Part, select Yes or No if the Family member or Guardian is filing the application for a minor or for a person who is unable to manage his/her own affairs.

- In the Fifth Part, mention the purpose for which you are applying the certificate. This is a mandatory field.

- In the Sixth Part, give the details of your Gross Income during the preceding financial year. You have to fill up the information relating to your income from Agriculture(including plantation, horticulture, dairying, poultry, fisheries, etc), Salary/wage/remuneration, etc., Business/ Trade/Profession, and other sources. You have to categorically specify the Business/Trade/Profession and the source of income if you mention that you have other sources.

- The Seventh Part reflects your total income in rupees.

- The Eighth Part is the declaration. Just read it and fill up the name of your place. Then select the box against I Agree.

- The Ninth Part shows the name of the Tahasil to which you want to submit your application. Enter the Captcha and click on Draft if you want to save the data otherwise click on Submit if you want to submit the application. A new page will open.

- Now you have to attach the documents.Here you should check the correctness of the data provided by you. If any wrong information is entered,it can be edited at this stage by clicking Edit Tab. Click on the link Attach Annexure at the bottom of the page.

- In the Tenth Part, you can upload Copy of RoR, Salary Certificate, Copy of IT Returns,if any. If you have other sources of income,then you can upload supporting documents with its specification.

- If you want to attach any other documents like self-declaration etc, you can upload the same against the OTHER tab. After uploading the documents, click on Save Annexure. On the new page, you can again check the details entered by you. If everything is found correct, then click on Submit. Your application will be submitted and the application reference number will be sent to your email and mobile phone confirming successful submission of the application.

The Government of Odisha has abolished the collection of application fee and user fee for income certificates through Gazette Notification No.2099 Dtd.18.11.2019 of the Revenue and Disaster Management Department. So no fee is charged for income certificate.

7.What is the time required for income certificate ?

As per the Odisha Miscellaneous Certificates Rules,2019, it was incumbent upon the complete Authority to grant Income Certificates to the applicant within 15 days. However, the Government of Odisha in Revenue and Disaster Management Department has reduced the timeline to 10 days through an executive instruction vide L.No. 11587/R&DM Dtd. 06.04.2021 of the Revenue and Disaster Management Department. In other words, the applicant shall be granted income Certificate within 10 days from the date of submission of the application.

8. How to track the status of the income certificate online?

The status of the income certificate can be verified from the eDistrict Portal.For this you need the application reference number. The status of the income Certificate can be checked through the Service Plus portal. For this, the Acknowledgement granted on successful submission of the applicant is badly necessary. For tracking the status of the income Certificate, the following steps should be followed:-

- Go to the Home page of the Service Plus portal at eDistrict Odisha

- Then go to the Check Your Application Status Tab.

- Click on the Tab and enter the application reference number and date of application. This information is available on the acknowledgment receipt.

Enter the CAPTCHA. The status of your application will be there on your screen.

9.How to download income certificate ?

To download the income Certificate from eDistrict Portal, one has to follow the following steps;

- Go to the portal at eDistrict Odisha. At the Right-hand top corner, there is the login button. Use your credentials and log in to the system.

- Click on "View status of Application". Then click "Track Application Status" under Menu.

- Select the Date Range and enter the Application Reference Number. Click on Get Data.

- Click on the Delivered link under Current Status.

- A pop-up window named Status of Application will be displayed. Scroll down and click on the output "income Certificate" link. The desired Certificate will be displayed on the screen. You can take the print now.

- The income Certificate will be sent to you by mail if you provide your email during the submission of the application.

10. How to verify income certificates?

The Income Certificate in Odisha can be verified through the following steps.

- Go to the Service Plus portal at eDistrict Odisha.

- Click on Verify Your Certificate.

Q No.1: I have registered in the eDistrict portal. How would I know my login ID?

Ans: Your email is your login ID.

Q. No.2 : My father is dead. Who can apply for income certificate for me ?

Ans: Your mother can apply for the certificate. If she is also dead, any member of your family can apply.

Q.No.3: Whose income details will be filled up in the application form ?

Ans: It is the income details of all members of the family in a common mess.Common mess means the persons who take meals from a common kitchen.

Q.No.4: Can the income certificate be renewed?

Ans: No, it cannot be renewed.

Q.No.5: In my Income certificate, it is mentioned that it is valid for the Financial Year 2023-24. What does it mean ?

Ans: It means it is valid till the end of the Financial Year,2023-24, i.e. till 31.03.2024.

Q.No.6: While granting income certificate, the income of which year is considered ?

Ans : The gross income of the preceding financial year is taken into consideration. For example, if you have applied for a certificate during FY 2023-24, then your income during FY 2022-23 would be considered.

Q.No.7 : I am a college student. I want income certificate for my admission/stipend. Would my father apply for the income certificate ?

Ans: Yes